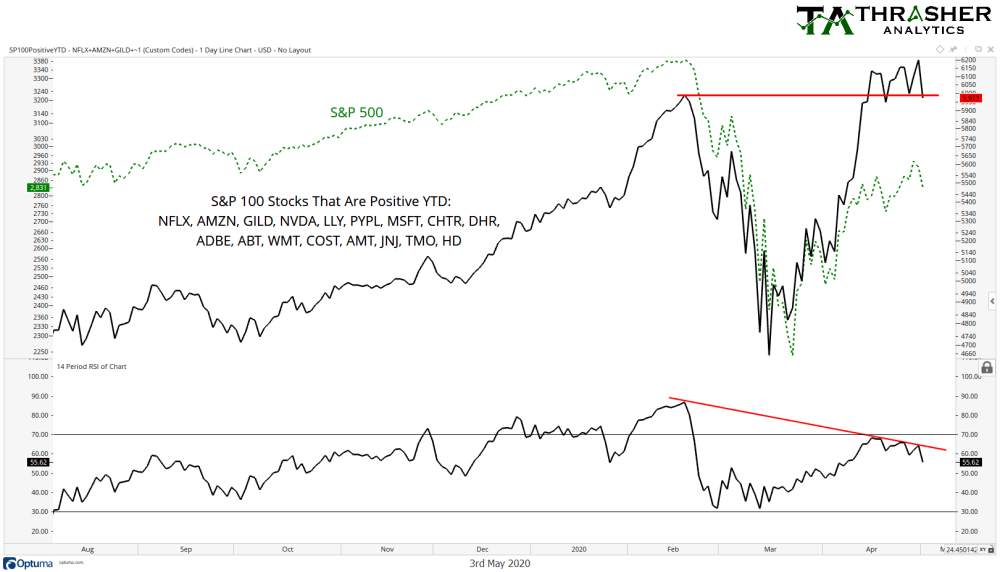

The bounce off the March low has been extremely impressive. As history has taught us, the momentum we often see on the move lower can be mimicked on the bounce higher. We saw these aggressive rallies several times during the tech-wreck and 2008 bear markets. Over the last month I’ve spent time studying the past bear market rallies and bear market bottoms, comparing them and looking for market characteristics that separate the two. These are topics I discuss in my Thrasher Analytics letter each week. I’ve said repeatedly on social media, my subscriber letter, and several times on TD Ameritrade Network how important the 200-day moving average is. During bear markets since the Great Depression the 200-day MA has been an area of contention for the equity market. We saw bear rallies fail in 2008, 2002, 1998, 1981, 1969, 1953, 1932, and 1920 at this key market level and we find ourselves today back just under this critical moving average.

It’s taken a strong move higher to get the S&P 500 back to its respective 200-day moving average. The sell-off was so intense, price left the long-term MA in the dust back in March. As the market has rallied, breadth has improved with more stocks rising back above their 50-day moving average a positive intermediate sign of market strength. We want to see a large number of S&P 500 companies show bullish price action to give us confidence in the index itself moving higher. Typically, after a bear market (or a strong correction) has bottomed we’ll see at least 85% of the index constituents move above the 50-MA. This sign of strength is rarely found in in bear markets, but it’s also not entirely absent either.

By combining both trend, as measured by the S&P 500 relationship with its 200-MA and breadth, with the percentage of stocks above their 50-day MA, we can more quantitatively evaluate the strength within the market and categorize a bear market rally from a true bottom.

Let’s look at some examples.

First up is Black Monday and the 1990 bear market. In ’87, the S&P fell over 30%, chopped around and then began to rebound in ’88. We saw breadth improve in March ’88 but price continued to show much strength as it traded sideways-to-down for a couple more months. Then in June we had a break above the 200-day MA with 89% of the stocks holding above their 50-MA. Then in mid-1990 we had a 20% bear market. Stocks made a few lower-lows and put in a final bottom in October. Stocks advanced, then dropped 6% at the end of the year before making the final push higher through the 200-day MA, signaling the market was ready to start a new bull market.

Then we have the two major bears from the last 30 years. Both the bear after the tech bubble and the Great Financial Crisis saw several counter-trend rallies. Each sucking in the vulnerable, thinking the coast was clear to return to equities only to see the market grind lower. A characteristic that was not found during these counter-trend rallies was a break above the 200-day and a strong level of breadth. That is, until the final lows were in place in October 2002 and March 2009.

Finally we have the sell-off in 2015 and 2016, the Q4 ’18 decline and today. In 2015 we saw stocks recover almost their entire decline until October before making another run to new lows at the start of 2016. There was a solid break above the 200-day MA in Nov. and Dec. ’15 but breadth was unfortunately not as strong as needed to show sustainability in the perceived new up trend. That changed in March ’16 when over 90% of the S&P recovered their 50-day MA and the market had enough support to have a sustained move higher.

Then we had Q4 2018. The S&P 500 broke above the 200-day MA three times during the process of the market selling off but breadth never saw more than 70% of stocks recover their key moving average. That changed in early February ’19, giving the needed confidence that selling has exhausted and a new trend up could be in store.

Finally we have today’s bear market. The S&P 500 has recovered a little over 30% since the March low, but has been unable to see a price break above the 200-day MA and less than 80% of stocks have recovered their own 50-day moving average. This lack of trend and breadth strength leaves a big question market if bulls have taken full control of the equity market.

Should we see further upside in price along with participation of individual stocks, this bear market may in fact be over. But until that happens, I remain skeptical.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter, and StockTwits.